BIDEN-XI DECOUPLED?

November 5, 2022 | Expert Insights

The recent restrictions of President Joe Biden on semiconductor exports to China have been widely seen as an American declaration of economic war against China. Depending on China's next step and the scope of the new US regulations will determine how far the decoupling process will advance. And how will the existing regime of export restrictions be received by the US's allies abroad and in the Indo-Pacific?

It's important to remember that China's Made in China 2025 programme really opened the path for official supply chain decoupling. The country intends to be free of Western technology, particularly semiconductors, within the next few years, as expressly stated in this announcement, which was made seven years ago (before the Trump presidency).

BACKGROUND

On August 25 of this year, the Biden administration released an Executive Order on the execution of the Chips Act of 2022, which unleashed a barrage of export control measures expected to have an unprecedented impact on the Chinese semiconductor industry. Most obviously, the ruling will bar US people (including Green Card holders) from working for a Chinese semiconductor company or providing support and know-how to them. It will also stop China from obtaining machines that make chips abroad. This action by the US government solidifies Washington's intention to sever ties with China, particularly in technology. The US hopes to achieve two key strategic goals – by limiting China's technological advancements and restricting China's economic and military ambitions.

The long-term Chinese risks to the tech industry have received substantial consideration from the Biden administration. Since 2017, the US administration has continuously used export bans to reduce China's technological competitiveness, and this practice has intensified. These constraints have hampered the technology interchange between China and the US across many industries.

ANALYSIS

After four years of watching Donald Trump's ineffective trade war inflict flesh wounds on China, US President Joe Biden appears to have found the jugular. The goal is the same, but this knife is sharper—and it could set back China's technological ambitions by a decade.

The target: semiconductor chips, particularly the state-of-the-art kind used in supercomputers and artificial intelligence systems. In contrast to past restrictions, the US's most recent export control measures are punitive. The fact that the "foreign direct product rule" was extended to nearly all Chinese companies in the semiconductor, supercomputing, quantum computing, and related fields makes the most recent round of export control restrictions extraordinary. This makes it nearly impossible for Chinese companies to obtain technology imports from other top global companies. According to the foreign direct product rule, the Export Administration Regulations (EAR(foreign-direct )'s products) re-export control restrictions may apply to manufacturing outside the US that directly uses US software or technology.

The impact of China's big technological decoupling from the US is projected to be seen in various areas in China for two key reasons: First, with an estimated $400 billion in imports, chips surpass crude oil as China's largest import. As a result, due to the export control restrictions, China will be forced to go inside to make up for the difference in the chip industry and other associated technology industries that depend on these imports. However, it is unlikely that such capabilities will be developed in the near future to meet the enormous home demand.

Second, China's significant semiconductor imports underpin the connections between these imports and other associated industries, which have shaped China's technical advancements over the previous ten years. The use of automation and artificial intelligence (AI) is anticipated to decline in China due to the adoption of export controls. According to estimates, among other industries, research and development in the pharmaceutical industry, cybersecurity, medical imaging, advances in climate science, autonomous vehicles, hypersonic weapons, and supply chain automation are among those that will be impacted by the most recent US export control measures.

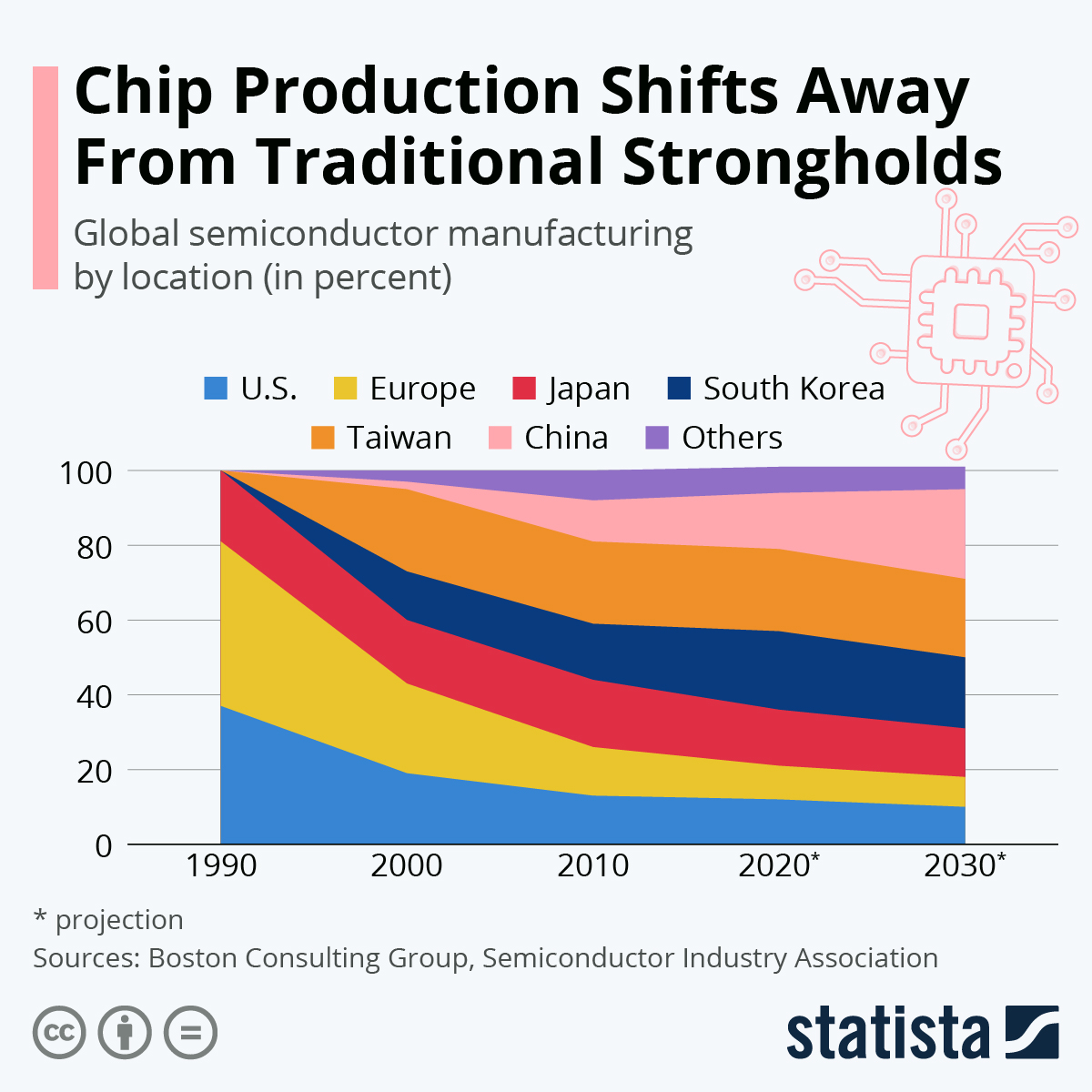

The US-China rivalry may be at the apex of a cycle of actions and reactions at the intersection of technology and security. The Biden administration's salvo on export control has received a muted response from China thus far. A deliberate Chinese approach to the impending technology crises should be anticipated, though. China may combine foreign influence with capacity building on the home front to overcome the crisis. The US is expected to cooperate with its other allies to maintain its dominance over the semiconductor market globally and widen the technological gap with China.

ASSESSMENT

- Forging a significant semiconductor agreement with Japan and the Netherlands—the three nations that produce 90% of the world's semiconductor manufacturing equipment—will be crucial for the US.

- It will be crucial to watch how the US bargains with its closest allies in the Chip 4 group—Japan, South Korea, and Taiwan—to get the required operating space for its new constraints. The US has already had trouble organising its Chip 4 alliance. The US may eventually need to coordinate regional tech policies with partners outside of the Chip 4 group in the Indo-Pacific.

- Countries and businesses require redundancy in their sourcing. Increased production of inexpensive chips and components in friendly countries like India and some of Eastern Europe would be a logical first step. In addition, executives must reconsider the notion that too much inventory is bad, representing a significant departure from just-in-time supply chain management.

Comments